A Hybrid Autoregressive Integrated Moving Average-phGMDH Model to Forecast Crude Oil Price

Abstract

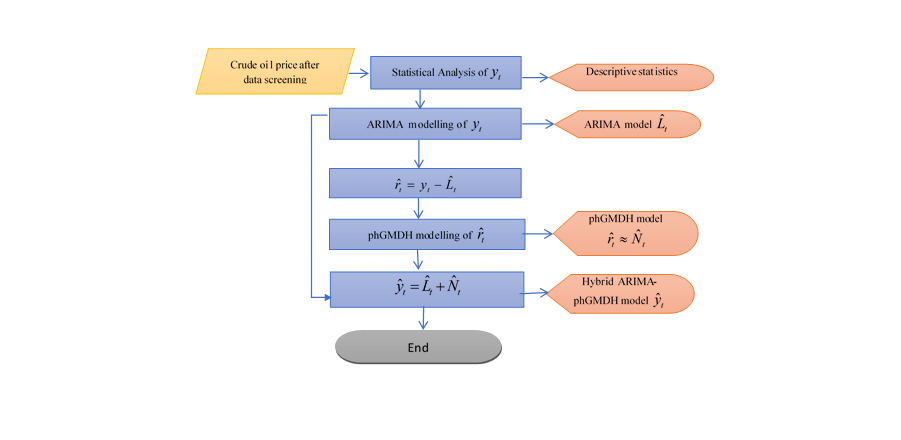

Crude oil price fluctuations affect almost every individual and activity on the planet. Forecasting the crude oil price is therefore an important concern especially in economic policy and financial circles as it enables stakeholders estimate crude oil price at a point in time. Autoregressive Integrated Moving Average has been an effective tool that has been used widely to model time series. Its limitation is the fact that it cannot model nonlinear systems sufficiently. This paper assesses the ability to build a robust forecasting model for the world crude oil price, Brent on the international market using a hybrid of two methods Autoregressive Integrated Moving Average and Polynomial Harmonic Group Method of Data Handling. Autoregressive Integrated Moving Average methodology is used to model the time series component with constant variance whilst the Polynomial Harmonic Group Method of Data Handling is used to model the harmonic Autoregressive Integrated Moving Average model residuals.Keywords: Autocorrelation, Harmonics, ResidualsJEL Classifications: C18, C45, C51, C63, C87, O13DOI: https://doi.org/10.32479/ijeep.7987

Downloads

Published

2019-07-23

How to Cite

Sarpong-Streetor, R. M. N. Y., Sokkalingam, R. A., Othman, M. bin, Ching, D. L. C., & Sakidin, H. bin. (2019). A Hybrid Autoregressive Integrated Moving Average-phGMDH Model to Forecast Crude Oil Price. International Journal of Energy Economics and Policy, 9(5), 135–141. Retrieved from https://econjournals.com/index.php/ijeep/article/view/7987

Issue

Section

Articles